Top 5 Digital Payment Solutions Trends

First introduced in the mid-90s, digital payments have been evolving as fast and loud as a finger snap.

Consumers are becoming more aware of their evolving needs, and advanced technology now offers new options and features that meet their changing payment preferences.

Cashless payments are quickly becoming the norm, but there’s so much more to digital payments than that. Below we are sharing some of the latest trends.

1. Digital "Speed of Need" Delivery

What we mean:

Products have their roadmaps; consumers have their preferences. If you want your business to prosper, these two pillars need to align.

Trend Advantages

EMPLOYER: Earn consumer trust and satisfaction

CARDHOLDER: Enjoy a highly personalized solution.

What we know:

Over half of consumers (53%) are now using non-bank mobile apps to make instant payments.1

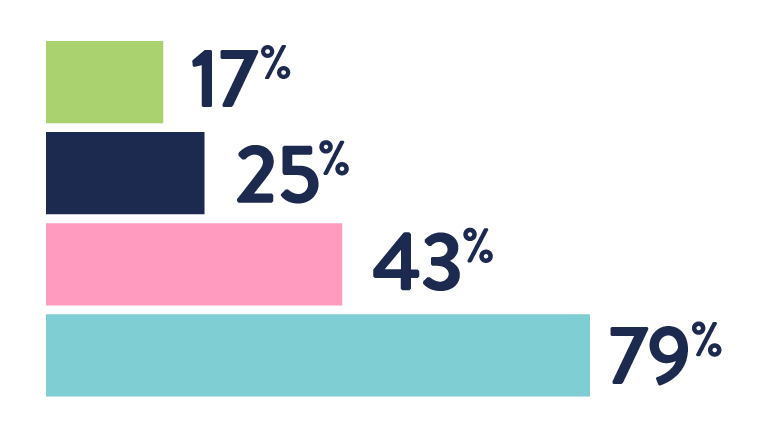

Preferred solution per generation:

- Baby boomers: paper-based payments. P2P use: 17%2

- Gen X: credit and debit cards. P2P use: 25%3

- Millennials: prepaid cards and P2P apps. P2P use: 43%4

- Gen Z: prepaid cards and digital wallets. P2P use: 79%5

2. Contactless Payments

What we mean:

Proximity mobile payment spending per mobile phone user is expected to reach $5,189 per mobile user in 2023. This is a 24.2% year-over-year increase from $4,177 in 2022.7

Trend Advantages

EMPLOYER: Easy to set up with low overhead.

CARDHOLDER: Quick and convenient payments.

What we know:

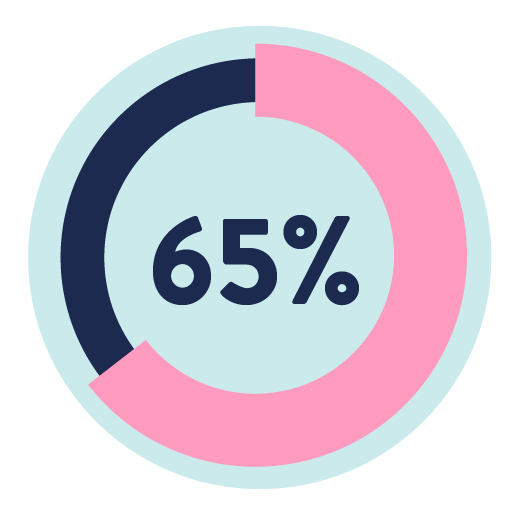

65% of consumers prefer contactless to traditional credit card payments. Total contactless payment transactions are expected to grow to more than $10 trillion by 2027, with a whopping 221% increase in contactless payments projected between now and 2026.6

3. Features, Features, Features

What we mean:

The past several years have seen an explosion of payments solutions that combine a great number of features, functionalities, and options of use. These solutions are referred to as super apps, and users love them.

Trend Advantages

EMPLOYER: Deliver value and convenience.

CARDHOLDER: Improved user experience.

Buy now, pay later market size is expected to expand by double digits every year from now to 2027. 8

What we know:

During 2022, mobile wallets made up 50% share of global e-commerce transaction value—they’re projected to get to 53% share by 2025.9

4. Embedded Payments

What we mean:

Thanks to nifty APIs, it’s easier than ever to incorporate payment options within any digital product—apps, ads, social media, etc.

What You Gain

EMPLOYER: Streamline back-end processes and generate more revenue.

CARDHOLDER: Faster transactions and a more accessible user interface.

What we know:

Worldwide, the industry is expected to grow at an annual growth rate of 32.2% between now and 2030.10

The US embedded finance market is expected to grow at an annual growth rate of 29% between now and 2032.11

5. Predictive Insights

What we mean:

Machine learning (ML) and artificial intelligence (AI) continue to leave their mark across the payments industry through the effective use of data to improve efficiencies and supercharge the user experience.

What You Gain

EMPLOYER: Advanced analytics to drive back-end processes.

CARDHOLDER: Improved user experience and value-added features.

What we know:

- AI is expected to help grow the U.S. GDP by 14.5 % by

2030 ($3.7 trillion), as it increases both productivity

and consumption.13 - 45% of total U.S. economic gains by 2030 will come from product enhancements driven by AI.14

Over the next 3 years, solutions that automate data collection will be the top investment for 66% of financial service organizations.

Dash Solutions: Digital Payments Solutions for the Future

As the payments industry continues to evolve, Dash Solutions stands at the forefront of this change. We know the market, we know the technology trends, and can help you leverage both to meet the needs of your organization. If you’re ready to transform your business, talk to one of our experts today to learn how we can help.

Sources:

- https://www.statista.com/statistics/218493/paypals-total-active-registered-accounts-from-2010/

- https://due.com/blog/different-demographics-prefer-different-payment-options/

- https://due.com/blog/different-demographics-prefer-different-payment-options/

- https://www.axerve.com/en/learn/insights/generation-payments-method-comparison

- https://truevo.com/blog/payments-basics/generation-z-and-why-their-opinion-of-payments-matter/

- https://fitsmallbusiness.com/contactless-payment-statistics/https://www.researchandmarkets.com/reports/4591881/contactless-payment-terminals-market-growth#tag-pos-1

- https://www.oberlo.com/statistics/us-mobile-payment-market#:~:text=Mobile%20payment%20market%3A%20proximity%20mobile,mobile%20phone%20user%20in%202023

- https://www.oberlo.com/statistics/buy-now-pay-later-market-size

- https://www.globenewswire.com/en/news-release/2022/03/11/2401655/28124/en/Global-Embedded-Payments-Market-Report-2022-Market-will-Increase-from-124-755-7-Million-in-2022-to-Reach-380-Billion-by-2029.html

- https://www.grandviewresearch.com/industryanalysis/embeddedfinancemarketreport#:~:text=The%20global%20embedded%20finance%20market%20size%20was%20estimated%20at%20USD,USD%2083.32%20billion%20in%202023

- https://www.gminsights.com/industry-analysis/embedded-finance-market#:~:text=Embedded%20Finance%20Market%20size%20was,financial%20services%20into%20various%20platforms

- https://www.pwc.com/gx/en/issues/data-and-analytics/publications/artificial-intelligence-study.html

- https://www.pwc.com/gx/en/issues/data-and-analytics/publications/artificial-intelligence-study.html

- https://globalfintechseries.com/big-data/the-whopping-cost-of-manual-processes-for-data-reconciliation/