Cutting checks might feel familiar and reliable, but for businesses, it’s more like death by a thousand fees—slow, costly, and completely avoidable. Worse yet, those pesty costs may go unnoticed while they quietly drain your bottom line.

In March, the White House announced an executive order to phase out paper check activities to and from the U.S. General Fund, citing “costs; delays; and risks of fraud, lost payments, theft, and inefficiencies.”

For businesses still using paper checks to pay individuals for things like refunds, payroll, and other outbound payments and disbursements, the obvious expenses are high but are only part of the story. Their true cost extends far beyond the face value. When factoring in things like bank fees, administrative time, fraud risks, and escheatment, checks impose a significant financial burden on businesses and their profitability.

The Direct Costs of Issuing Checks

Bank Fees

The humble paper check, seemingly simple, hides a surprisingly complex and costly journey behind its face value. Each time a check is written, it sets in motion a chain of manual processes, banking procedures, and security protocols that drive up its processing costs for the check cutter. Then follows an intricate dance within the banking system, where checks navigate clearing and settlement, even with electronic imaging playing a role.

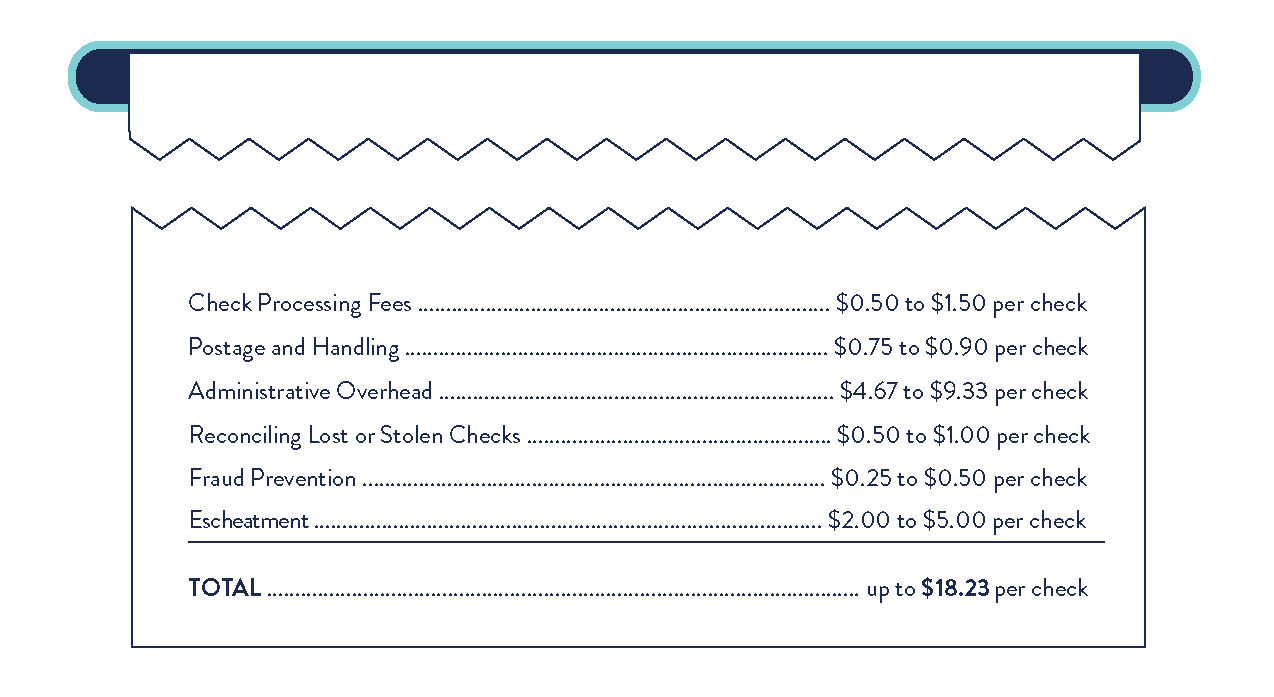

As a result, each check issued comes with a tangible cost to the businesses writing them. Check processing fees alone typically cost businesses from $0.50 to $1.50 per check 1. While this might seem small in isolation, for companies issuing hundreds or thousands of checks each payroll cycle, these costs add up quickly. It’s also simply one wedge in the overall check-cost pie.

Postage

While postage costs may appear negligible in the grand scheme of expenses a business faces, the true postage payment toll goes beyond the cost of the stamp and to a ripple effect through the entire process, adding more expense to the check fees you pay.

Consider the sheer volume of checks a medium-sized business might send out monthly, like physical pay checks for non-ACH workers, refunds paid to customers for things like overpayments and reimbursements, appeasement payments, rewards and incentives paid to employees or partners, and more. Each envelope represents a tangible cost, multiplied by the number of employees, customers, and partners.

Moreover, businesses often need to track these mailed checks, adding another layer of administrative overhead. In a world where electronic payments offer instant, trackable transactions, the reliance on paper checks and postage for business disbursements becomes a glaring inefficiency, a drain on resources that could be better allocated elsewhere.

For companies that mail checks rather than distributing them in person, postage and handling can add another $0.75 to $0.90 per check 2. While many organizations may distribute checks onsite, mailed checks remain a factor for many payments to customers, partners, and employees.

Administrative Overhead

Even for companies utilizing a bank to issue disbursement checks, the labor costs can be significant and multifaceted. Initially, internal teams must often dedicate time to compiling and verifying payment details, then accurately inputting or uploading that data to the bank’s system.

Crucially, they must meticulously reconcile the bank’s check register with internal company records to ensure accuracy and detect any discrepancies. Handling inquiries about check status from employees, customers, or vendors further consumes valuable time. Finally, managing check stock, voiding checks, and resolving exceptions or errors contribute to the workload. These tasks, though seemingly routine, collectively represent a substantial investment of the finance team’s time, highlighting the often-overlooked labor costs associated with paper check disbursements.

Administrators can spend a collective average of 10 to 20 minutes per check on processing, distribution, and responding to check-related inquiries. With an average administrator wage of $28 per hour, that translates to an additional $4.67 to $9.33 per check in labor costs. 3

Lost or Stolen Checks

Unlike digital payments, paper checks can be easily misplaced, lost, or stolen, leading to more business intervention, and thus, costs. Finance teams must initiate stop-payment orders and issue replacements, consuming valuable time. Payment delays caused by missing checks can strain relationships between payors and payees. Though a more hidden toll, the risk of reputational damage further adds to the cost. The unpredictable nature of these incidents makes them a significant financial liability. The United States Postal Inspection Service recovers more than $1Billion in fraudulent checks and money orders each year.

The average additional cost per check due to time and administration reacting to these risks is estimated at $0.50 to $1.00 4.

Fraud Prevention & Monitoring

In addition to responding to risks, businesses must prevent them from happening. Potential fraud from forged checks can lead to financial losses and extensive investigations. Paper checks remain one of the most fraud-prone payment methods. Stolen checks can be easily altered or forged, leading to unauthorized withdrawals and direct financial losses.

The Association for Financial Professionals reported that 47% of organizations experienced fraud involving paper checks in 2023. In that same year, the Financial Crimes Enforcement Network (FinCEN) received 15,417 Bank Secrecy Act reports related to mail theft and check fraud between February 27 and August 31, amounting to over $688 million in suspicious activities during that six-month period.

Finance teams must dedicate substantial time to investigating these incidents, working with banks to recover funds, and implementing preventative measures. Ultimately, the vulnerability of paper checks to fraudulent activity necessitates constant vigilance and resource allocation, making it a costly and ongoing concern.

Businesses must often invest their own funds into security measures to prevent theft and fraudulent check alterations, adding an estimated $0.25 to $0.50 per check 5 in additional costs. Additionally, it’s believed that the average mid-sized business leaks a range of $5,000 to $250,000 per year 6 due to check fraud, depending on factors like industry, fraud prevention measures, and check-writing frequency. This leads to a safe average of an additional $2.14 loss per check 7.

Escheatment Compliance

Escheatment creates hidden costs for businesses using paper checks. Escheatment is the legal obligation to transfer unclaimed funds or property to the state after a designated period of inactivity, due to an inability to locate the rightful owner. Uncashed checks eventually fall under state escheatment laws, requiring businesses to track, report, and remit these funds. This process demands significant finance team time, meticulous record-keeping, and legal compliance. Failure to comply leads to potential penalties and fines. The ongoing monitoring and reporting add to administrative overhead, making escheatment a costly, often overlooked, burden.

Uncashed checks don’t just disappear; businesses are responsible for tracking and reporting unclaimed funds, which can lead to escheatment obligations. Managing these uncashed payments costs an estimated $2.00 to $5.00 per check 8, creating an ongoing administrative burden.

The Bottom Line: Modernizing Payments is the Way, Paper Checks Are More Expensive Than They Seem

While the obvious expense per check can cost a few bucks, when all costs are considered, each paper check issued can cost businesses a fully-loaded toll of anywhere from $16.81 to $19.87 per check 9—a price that far exceeds check alternatives like Dash Solutions provides to clients.

Businesses looking to optimize their operations by modernizing payments, reduce unnecessary costs, and improve the employee experience should consider transitioning to modern disbursement methods that eliminate the hidden toll of paper checks.

Sources:

1, 4, 5, 6, 7, 8 Dash Solutions (2025), unpublished internal company data